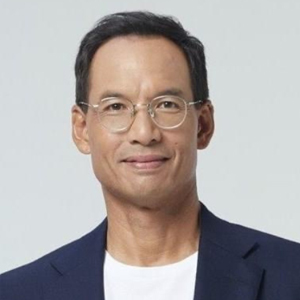

Dr. Atiur Rahman is a Professor of Department of Development Studies, University of Dhaka. Dr. Rahman served as the Governor of Central Bank of Bangladesh during the period of May 2009-March 2016.

Dr. Rahman popularly known as the ‘Poor Peoples’ Economist’ and a Green Governor is a many times awarded central bank governor with a human face. Son of a marginal farmer and a life-long campaigner Dr. Rahman has demonstrated his commitment for empowering the poor and the disadvantaged both as a teacher and a regulator.

The defining feature of his tenure as the Governor of the central bank of Bangladesh was his decisive drive reorienting the institutional objectives and ethos to support a pro-poor, inclusive and sustainable development model through his flagship initiatives of financial inclusion and environmentally benign banking.

He made significant contribution in the 3GF conference, Rio+20, COP18 and MDG Global Compact international negotiations linking sustainability and socio-economic development goals as a member/panelist of Bangladesh delegation. He was also a member of the UNEP Enquiry on designing ‘global sustainable financing’. Under his dynamic leadership, Bangladesh Bank was awarded the ‘Best Employer of the Year 2014’ by Bdjobs.com (the largest online job portal in Bangladesh).

After obtaining M.A. in Economics from Dhaka University, he pursued studies in the School of Oriental and African Studies (SOAS), University of London under a Commonwealth Scholarship, securing M.A. and Ph.D. in Economics (1983). He was also awarded a Commonwealth Development Fellowship at the University of Manitoba in Canada (1989), and a Ford Foundation Post Doctoral Fellowship at The University of London (1991-92)

He has published 56 books in English and Bengali, besides, numerous papers in national and international journals. He is currently devoting his time in inspiring his students at the Dhaka University about how to overcome the multifaceted challenges of development. In addition, he is travelling around the world advocating inclusive sustainable development, green finance movement and promoting peace building through participatory development.

TOPICS:

- Monetary policy innovations and inclusive growth.

- Sustainable Finance for inclusive development.

- Mobile Financial Services through bank-ledmodels.

- Making Human Capital More Humane in the financial sector.